- Israfan

- Posts

- NYC Mayor’s Office Alleges Comptroller Supported BDS by Divesting from Israel Bonds

NYC Mayor’s Office Alleges Comptroller Supported BDS by Divesting from Israel Bonds

A partisan clash erupts as pension divestment from Israel sparks debate over loyalty and fiscal duty.

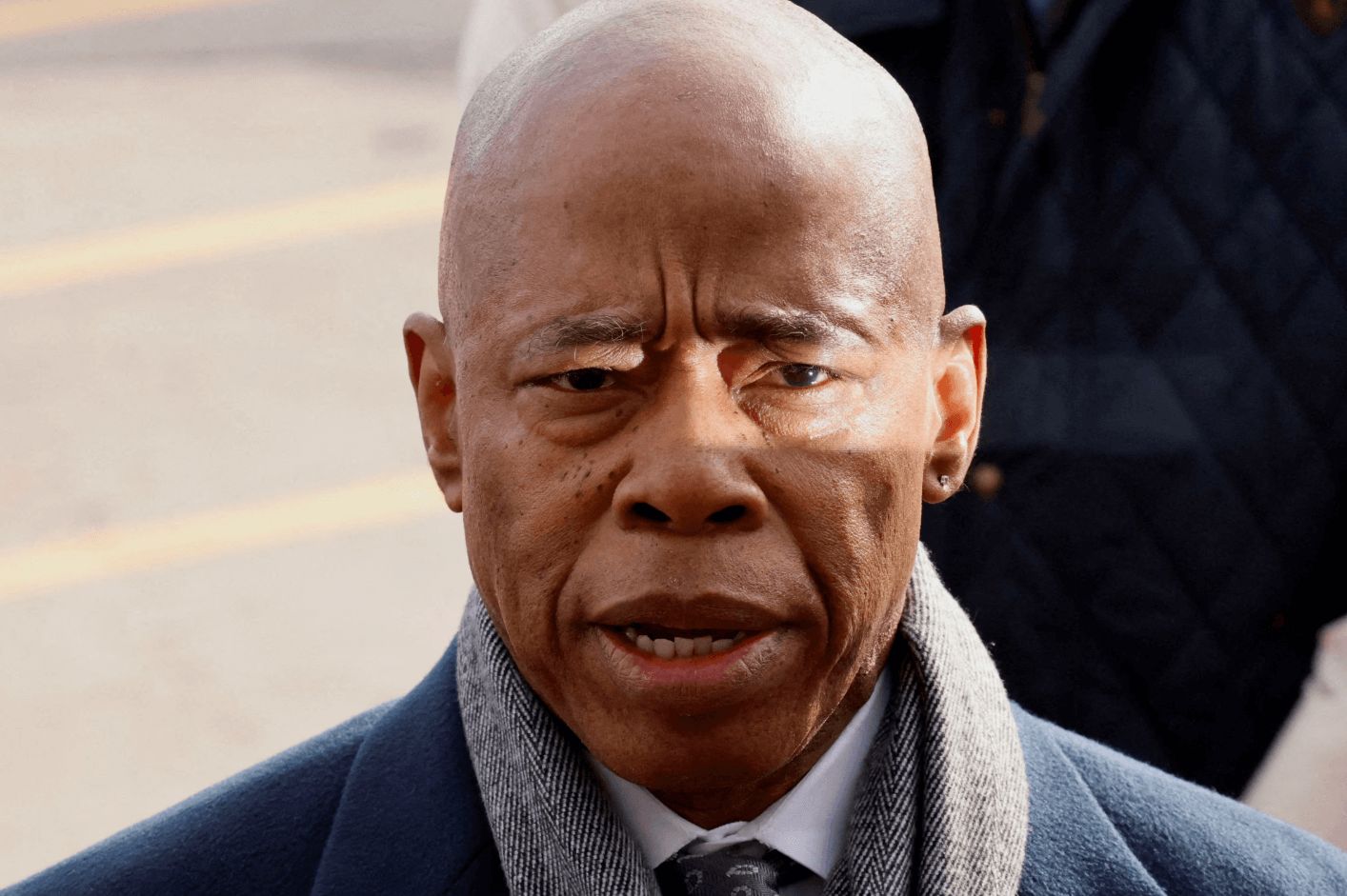

Mayor Eric Adams’ office has accused NYC Comptroller Brad Lander of aligning with the anti-Israel BDS movement after Lander allowed city pension bond holdings in Israel to lapse following maturity. In a July 10 letter, First Deputy Mayor Randy Mastro demanded a full review, citing Adams officials’ concern that millions once held since 1974 were allowed to drop to around $1.2 million in just the Police Pension Fund.

For decades, successive comptrollers routinely reinvested Israel Bonds securities tied to strong, roughly 5% annual returns. Mayor Adams argues Lander’s decision not to reinvest could have hurt pension performance, accusing him of “pandering to the antisemitic BDS movement at the expense of taxpayer dollars.”

Lander’s office says the move wasn’t discriminatory. They say a standing policy bans foreign sovereign debt across all nations, and this just happened to apply when Israel Bonds matured. They emphasize the city still holds over $315 million in Israeli equities, including stocks and real estate trusts. Lander, who is Jewish and identifies as a progressive Zionist, said he opposes BDS and is committed to fiduciary duty.

This feud quickly took on political overtones: Mayor Adams, running for re‑election as an independent, is courting Jewish voters, while Lander is aligned with Democratic candidate Zohran Mamdani, a BDS advocate. The letter cites concerns that withdrawing from Israel Bonds when they outperformed alternatives may have been a coordinated political gesture.

Now Mastro has demanded all documents related to the decision memos, consultant reports, external communications by July 17. Lander’s office decries the demand as a politicized attempt to weaponize antisemitism against a Jewish official, noting the bond holdings were allowed to mature rather than forcibly divested.

The clash spotlights tensions between diplomatic messaging, fiscal duty, and electoral strategy. Critics argue that principled investment policy was overshadowed by the optics of foreign policy, while supporters see Lander’s move as a financial safeguard not a political snub.

With millions still invested in Israel through equities, the anti-Israel accusations may not reflect the full picture. The coming release of documents could clarify whether this was a cost-saving policy or a calculated political shift.

As New Yorkers weigh trust in leaders against global alliances, this episode underscores how local fiscal decisions can become proxy battlegrounds in national debates over Israel’s standing and New York’s political future. Share this article or subscribe to our newsletter for updates.